Econ

经济学代做 Assume that β = 0.98,σ=2,θ=2,ψ=2,A=1,a=0.36,δ= 0.05,tc=0.05,tk= 0.25, and tn = 0.20. Find the steady state solution using Dynare.

1 Question 1: The OLG model with elastic labor and govern-ment 经济学代做

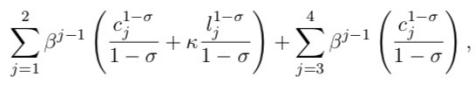

We now consider an overlapping generations model in which households value both consumption good and leisure. The preference is given by

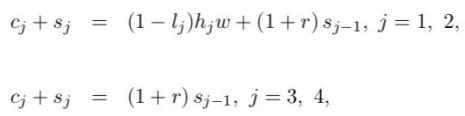

where,lj is leisure and K is a parameter governing flow of utility from leisure. For simplicity,we also assume that when households are retired leisure is not a choice variable any more. The household budget constraints are given by

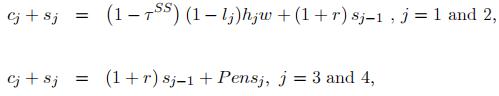

where, (1 -lj)hjw is labor income, (1 +r)sj-1 is investment income, and s0= 0.

a) Assume that h1 = 1, h2= 1.5,β=0.98,σ=2, K=3, A=1,a= 0.36 and δ = 0.05. Solve the model using the Gauss -Seidel algorithm.

b) Find the value of β to match anmual interest rate of 4%. Report graphs of consumption,savings, labor supply, and labor earnings over the life cycle when r= 4%.

c) Now assume that there is a pay-as-you-go (PAYG) social security system in which the government collects social security taxes (τss) from the current working generations to pay social security benefits of the current retiring generations. We let Pensj =ψwH denote social security benefits, where ψ is a replacement rate and wH is average labor income. The household budget constraints are given by

where, (1 -lj)hjw is labor income, (1 +r) sj-1 is investment income, and s0 = 0.

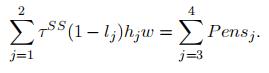

The government budget constraint is balanced each period

Note that, we assume that social security tax rate (τss) adjusts to balance the government budget.

Assume that h1= 1,h2=15,β=0.98,σ=2,k=3,A=1, a= 0.36, δ = 0.05 and Ψ= 0.4. Solve the model using the Gauss- Seidel algorithm.

d) Now, consider a social security reform in which the government cuts generosity of the social security system by reducing the replacement rate to Ψ= 0.2. Determine the effects on the market wage and interest rates, and on aggregate capital, labor and output. Report the life-cycle profiles of consumption, savings, labor supply and labor earnings before and after the reform. Discuss the results.

2 Question 2: The Neoclassical growth model with elastic labor and government 经济学代做

We consider a closed economy model filled with a representative household, a representative firm and a government. Time is discrete(t= 0, 1,..).

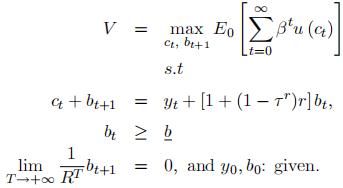

[1] The representative household lives infinitely and has the following preference:

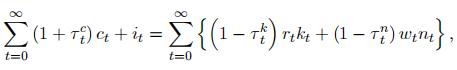

where β is the time discount factor, a is consumption, lt is leisure and u(ct)= The agent is given capital ko initially and one unit of time in each period. The agent can invest in capital market. The labor supply is nt = 1一l1. The houshold lifetime budget constraint is

where Ct and it are consumption and investment; Tt is rental rate; and Wt is wage rate; Tf,生 and TR are taxes on consumption, capital income and labor income, respectively. The law of motion for capital is

where capital depreciates at a constant rate δ.

[2] There is a representative firm which has access to the following CRS technology:

where, At is the total factor productivity, kt is capital input and nt is labor input. The representative firm rents inputs in competitive markets.

[3] The government collects tax renenues to finance an investment subsidy program and a sequence of government purchases. The government lifetime budget constraint is given by

a) Assume that β = 0.98,σ=2,θ=2,ψ=2,A=1,a=0.36,δ= 0.05,tc=0.05,tk= 0.25, and tn = 0.20. Find the steady state solution using Dynare. 经济学代做

b) Start from the steady state in (a) and assume that there will be a decrease in TFP for 10 periods ahead, At+10 = 0.95. Detemine the dynamic effects of such TFP shock on macroeconomic aggregates and prices, including capital, labor supply, output, the wage and interest rates. Explain the underlying mechanism.

c) Start from the steady state in (a) and assume that the government cuts labor income tax rate to 15% forever. Detemine the dynamic effects of the tax cut on the economy, includ-ing capital, labor supply, output, the wage and interest rates. Explain the underlying mechanism.

d) Assume that the government cuts capital income tax from 25% to 20% immediately in response to the negative TFP shock in (b). Detemine the effects of the on the economy.Are there any difences in macroeconomic variables when comparing to (b)? Why?

3 Question 3: Taxes and consumption-saving 经济学代做

Consider a simple model of endowment economy filled with a mass of infinitely lived agents.At begining of each time period, agents are endowed an amount of income Yt, which follows a stochastic process that has two states: low and high,

, where, β∈(0,1) and ct is consumption at time t. There are no insurance

markets available. However, agents can either save or borrow to a certain limit (b). The market interest rate is 1 + r. The capital income tax rate is τr. An agent chooses consumption (ct) and bond holdings (bt+1) to solve his/her utility max-imization problem according to

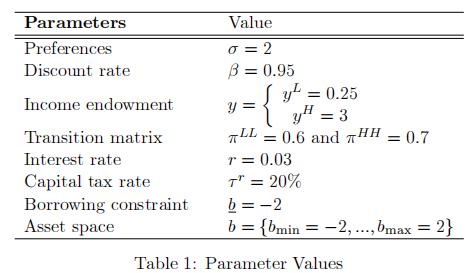

Assume the folowing parameter values

a) Consider a partial equilibrium economy in which the market interest is constant at 3%.Solve the household problem numerically, using value function iteration. Obtain the household’s decision rules and value functions, and simulate the distribution of agents. 经济学代做

b) Consider a partial equilibrium economy as in a). Remove the capital income tax (τr= 0)and report the effects on the decision rules and value functions.

c) Construct a measure of wealth inequality (Gini coefficient) and show the effects on wealth inequality when moving from a) to b).

更多代写:经济学Final exam代考 gre作弊后果 理科计算机代写 空间设计Essay代写 历史学论文代写 代写网

合作平台:essay代写 论文代写 写手招聘 英国留学生代写